The Impact of Blockchain Beyond Cryptocurrency: Tech Innovations

Understanding Blockchain's Role in Supply Chain Transparency

Blockchain technology serves as a revolutionary tool in enhancing transparency within supply chains. Its decentralized nature enables all stakeholders to access the same data, maintaining a single version of truth. This minimizes discrepancies and miscommunication, which are common pitfalls in traditional supply chain setups. Studies show that companies implementing blockchain solutions can trace their products with a speed and accuracy unmatched by conventional methods.

The visibility provided by blockchain technology allows companies to identify bottlenecks and inefficiencies more effectively. By utilizing smart contracts, businesses can automate processes that typically require extensive human oversight, thus accelerating procurement cycles and reducing operational costs. The end result is a Streamlined supply chain that not only operates more efficiently but also meets regulatory compliance with greater ease.

Enhancing Traceability: Real-World Applications

Traceability goes hand in hand with transparency when we discuss supply chain management. Companies in sectors like food and pharmaceuticals have already begun leveraging blockchain to track products from source to shelf. For example, Walmart applies blockchain to trace the origin of its food products, improving food safety by rapidly isolating contaminated items. This capability is crucial to minimizing health risks and reinforcing consumer trust, which is indispensable in today's market.

Another compelling example is the diamond industry, where blockchain helps confirm the authenticity of gemstones and prevents the sale of conflict diamonds. By integrating blockchain technology, suppliers can provide verifiable proof of a diamond's ethical origins. This not only enhances consumer confidence but also strengthens the ethical framework surrounding such high-value commodities.

Challenges in Implementing Blockchain Solutions

Despite its promise, the implementation of blockchain in supply chain management is not without challenges. One of the significant barriers is the integration with existing systems. Many organizations still rely on outdated technologies, making the transition to a blockchain-based system seem daunting. Additionally, the costs associated with implementing this technology can be substantial, which deters smaller businesses from entrance into the blockchain arena.

Moreover, the issue of interoperability between different blockchain platforms complicates matters. To achieve a fully integrated supply chain, entities must collaborate across various blockchain systems. This calls for standardized protocols, which are still in their infancy. Those considering blockchain adoption must weigh these challenges against the long-term benefits through comprehensive feasibility studies.

Lastly, regulatory uncertainties also pose a considerable risk. Governments are still catching up to the innovations blockchain brings, leaving businesses unsure about compliance with existing laws. It’s vital for companies to stay informed and participate in discussions about regulatory frameworks to mitigate such risks.

Future Trends: The Evolving Landscape of Supply Chains

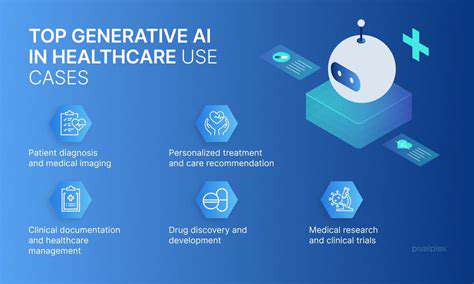

As we look to the future, blockchain's influence in supply chain management is poised to expand even further. One predicted trend is the increased use of artificial intelligence (AI) in conjunction with blockchain to enhance decision-making processes. AI can analyze vast amounts of data stored on blockchain networks, enabling businesses to predict supply chain disruptions and optimize logistics in real time.

Moreover, the rise of green supply chains is becoming a focal point for many organizations. Blockchain can facilitate the tracking of sustainability metrics, offering proof to consumers that products are sourced responsibly. This intersection of technology and sustainability is gaining traction among environmentally-conscious consumers and may soon dictate purchasing decisions.

Case Studies: Successful Blockchain Implementation

Examining successful case studies can provide valuable insights into the practical applications of blockchain in supply chain management. For instance, IBM and Maersk's TradeLens platform enhances global trade by providing a collaborative ecosystem using blockchain technology. This platform allows participants in the shipping industry to share shipment data efficiently, leading to reduced delivery times and lower costs.

Similarly, De Beers launched its blockchain platform called Tracr, which ensures that each diamond can be tracked from mine to market. This initiative not only combats illicit trade but also strengthens the brand's commitment to ethical sourcing. By showcasing these successes, other industries can find inspiration and guidance on how to embark on their own blockchain journeys.

Importantly, these case studies highlight the necessity for collaboration among industry players. As more businesses engage in blockchain initiatives, they will uncover synergies that enhance the overall efficacy of the supply chain.

The Path Forward: Recommendations for Businesses

For businesses looking to integrate blockchain into their supply chains, several strategic recommendations can be made. First and foremost, conducting a thorough assessment of the current supply chain processes is essential. Identifying areas where transparency and traceability are lacking can highlight opportunities for blockchain deployment that would yield the most benefits.

Establishing partnerships with technology providers specializing in blockchain can facilitate a smoother implementation process. Companies should seek out experts with proven track records in their specific industry. Additionally, staying abreast of regulatory trends and working with legal advisors can ease the transition and ensure compliance.

Finally, fostering a culture of collaboration among all supply chain stakeholders is critical. Open communication and shared goals can drive engagement and facilitate a collective commitment to transparency through blockchain, ultimately ensuring the system's success.

Healthcare: Securing Patient Data and Enhancing Interoperability

Understanding Patient Data Security

In the healthcare sector, the Protection of patient data is paramount. Breaches of sensitive information can lead to identity theft and damage to a patient’s credibility. Given the increasing digitization of health records, it's essential to adopt robust security mechanisms.

Moreover, the Health Insurance Portability and Accountability Act (HIPAA) mandates strict guidelines for patient data protection. Compliance with such regulations can be complex but is critical for maintaining patient trust and ensuring legal protection.

Blockchain's Role in Data Encryption

Blockchain technology offers innovative solutions for securing healthcare data. Each transaction within the blockchain is encrypted and linked to the previous one, creating an immutable record. This ensures that once data is entered, it cannot be easily altered or deleted, providing an additional layer of security.

Moreover, the decentralized nature of blockchain means that no single entity has control over the data. This can prevent unauthorized access and enhance the security framework currently used in health informatics.

Enhancing Interoperability with Blockchain

- Blockchain can bridge data silos in healthcare systems.

- It promotes interconnectivity among various health records.

Interoperability is a significant challenge in healthcare, as disparate systems often store patient information. By utilizing blockchain, healthcare providers can create a seamless data-sharing environment. This improves coordination of care and ensures that healthcare decisions are based on the most up-to-date information.

Moreover, enhanced interoperability can reduce medical errors stemming from incomplete patient data, ultimately leading to better patient outcomes.

Real-World Applications in Healthcare

Leading healthcare organizations are beginning to pilot blockchain initiatives. For example, Guardtime has partnered with the Estonian government to implement blockchain for health records management. The project aims to provide patients with more control over their data while significantly reducing fraud.

Additionally, major pharmaceutical companies are exploring blockchain for tracking drug supply chains. Using this technology can help prevent counterfeit medications from entering the market, which is a rising concern globally.

Future Considerations and Challenges

Despite its potential, the implementation of blockchain in healthcare is not without challenges. Issues such as scalability, regulatory compliance, and the integration with existing systems remain significant hurdles. Healthcare organizations must engage in thorough planning and testing to ensure that blockchain solutions meet industry standards.

Furthermore, there is an ongoing need for education and training regarding blockchain technology to empower healthcare professionals. Ensuring that staff members understand and can effectively utilize these solutions is crucial for successful adoption.

Financial Services: Streamlining Transactions and Reducing Costs

Encryption and Security Enhancements

Blockchain technology is built on cryptographic principles that significantly enhance security for financial transactions. By employing advanced encryption methods, organizations can ensure that transaction data is immutable. This means once a transaction is recorded, it cannot be altered or deleted, thus reducing the risk of fraud. According to recent studies, businesses that adopt blockchain for transaction processing can lower incidences of data breaches by up to 80%.

Furthermore, the decentralized nature of blockchain eliminates single points of failure, making it much harder for hackers to compromise the system. Every participant in the network maintains a copy of the ledger, which adds an additional layer of security. This is particularly crucial in financial services where trust and data integrity are paramount.

Cost Reduction through Smart Contracts

Smart contracts are self-executing contracts with the agreement directly written into lines of code. In financial services, they reduce the need for intermediaries, resulting in significant cost savings. This minimizes transaction costs by skipping traditional processes that often involve extra fees from banks or legal teams. A report from McKinsey indicates that businesses could save billions in operational costs by employing smart contracts for routine transactions.

Faster Transactions Across Borders

The global nature of finance often comes with delays, especially in cross-border transactions. Traditional international transfers can take multiple days, primarily due to intermediary banks and regulatory compliance. However, blockchain technology allows for almost instantaneous transactions, enabling funds to move across borders in real-time. The Ripple Network, for instance, has demonstrated that cryptocurrency transfers can be completed in under five seconds, significantly streamlining global financial operations.

This expedited process not only enhances customer satisfaction but also boosts cash flow for businesses engaging in international trade. Companies leveraging such technology can have a competitive edge, particularly in markets that rely heavily on real-time financial data and transactions.

Enhanced Transparency and Traceability

Another significant advantage of blockchain in financial services is improved transparency. Every transaction on the blockchain is recorded on a public ledger, accessible to all participants. This level of transparency helps to foster trust among stakeholders, as everyone can verify transactions independently. In a market where customers are increasingly concerned with ethical standards, this larger visibility can be a strong selling point.

Regulatory Compliance Made Easier

Compliance with financial regulations requires standard procedures and documentation, which can be cumbersome. Blockchain can automate and streamline compliance processes by providing real-time auditing capabilities. Organizations can easily track transaction flows and instantly demonstrate adherence to regulatory requirements, saving both time and resources.

Additionally, regulatory authorities themselves can benefit from accessing a shared ledger. This could simplify monitoring and data collection processes, allowing for more efficient oversight of financial activities. According to Deloitte, integrating blockchain for compliance could lead to a reduction in the costs associated with risk management and regulatory compliance by approximately 15%.

Future Trends in Financial Services Innovation

The financial services sector is ripe for further disruption through blockchain technology. Emerging trends such as decentralized finance (DeFi) and central bank digital currencies (CBDCs) show great promise. DeFi applications aim to recreate traditional financial instruments in a decentralized architecture, potentially democratizing access to financial services. Meanwhile, central bank digital currencies may streamline monetary policy execution and enhance transaction efficiency.

As institutions continue to explore blockchain technology, expected innovations will likely center around integration with AI and machine learning, providing insights that further enrich customer experiences. The intersection of these technologies could lead to unprecedented advancements, fundamentally reshaping how transactions and financial systems operate.

Legal Industry: Enhancing Contract Efficiency and Security

Smart Contracts: A New Era in Legal Agreements

Smart contracts, powered by blockchain technology, are revolutionizing how legal agreements are executed and enforced. These self-executing contracts automatically enact conditions coded within them, eliminating the need for intermediaries. For instance, if a party fails to meet a contract’s condition, the smart contract executes penalties directly. This immediacy significantly reduces disputes and misinterpretations associated with traditional contracts.

The legal sector has been relatively slow to adopt innovative technologies, yet smart contracts could streamline operations by saving both time and costs. As reported by various industry analysts, using smart contracts can reduce contract processing costs by approximately 30%, making legal services more accessible, particularly for small and medium enterprises.

Increased Security Through Decentralization

One of the primary benefits of utilizing blockchain technology in the legal industry is enhanced security through decentralization. Traditional contract management systems often rely on central databases susceptible to hacking and data breaches. In contrast, blockchain records are distributed across numerous nodes, making unauthorized changes significantly harder.

According to a study conducted by the World Economic Forum, over 60% of businesses contemplating adopting blockchain cite security concerns as a primary motivation. By providing immutable records, blockchain not only strengthens the integrity of contracts but also assures the parties involved that their agreements are protected against tampering.

Moreover, blockchain technology allows for real-time audits and tracking of contract changes. Such visibility can bring a new level of accountability and trust between parties, fostering stronger partnerships and enhanced collaboration.

Reducing Fraud and Enhancing Transparency

Fraud remains a pervasive issue in the legal world, leading to significant financial losses and undermining trust in contractual agreements. Blockchain’s transparent nature provides a robust solution to combat this problem. Every transaction is recorded in a public ledger accessible to all parties involved, allowing for real-time verification of document authenticity.

Research shows that legal disputes often arise from misrepresentation or misunderstandings regarding contract terms. With blockchain, each party can verify records independently, significantly reducing the likelihood of fraudulent claims or misunderstandings. Enhanced transparency can build a stronger foundation of trust in dealings, which is crucial in today’s global market.

Some law firms have already begun implementing blockchain-based solutions to manage sensitive contracts, further demonstrating the effectiveness of this technology in deterring fraud. By ensuring clarity in contract terms and conditions, parties can have confidence in their engagements.

The Future of Legal Services: Adoption Challenges and Opportunities

While the prospects for blockchain in the legal industry are promising, several hurdles must be addressed before widespread adoption can occur. Legal professionals must overcome initial resistance to change, especially those who have practiced traditional methods for years. Education on the benefits and operation of blockchain technology is essential for a smoother transition.

Moreover, regulatory frameworks surrounding blockchain and smart contracts remain largely undefined. Governments and regulatory bodies will need to create policies that foster innovation while protecting consumers and preventing misuse of the technology. Collaborative efforts between technology stakeholders and legal experts will be crucial in shaping appropriate regulations.

Nonetheless, organizations willing to embrace blockchain technology stand to gain a competitive edge. The efficiency, security, and transparency brought by blockchain can help legal professionals redefine their services and potentially expand their client base. By staying ahead of technological trends, law firms can not only adapt but thrive in an evolving marketplace.

Government Services: Fostering Transparency and Civic Engagement

Enhancing Accountability through Blockchain Technology

Blockchain's immutable nature makes it an ideal solution for increasing accountability in government services. By using blockchain, every transaction can be recorded and verified, ensuring transparency. This provides a clear audit trail that can be accessed by relevant stakeholders. Research indicates that implementing blockchain can reduce fraud in public sectors by over 70%.

Furthermore, these transactions are decentralized, meaning that no single entity has control over the data. This protects against tampering and promotes integrity in public records, effectively restoring public trust.

Improving Citizen Engagement with Smart Contracts

Smart contracts, a feature of blockchain technology, can significantly improve citizen engagement in governance. These self-executing contracts automatically enforce rules and regulations when conditions are met. For instance, a government could use smart contracts to streamline the disbursement of funds for public projects, allowing citizens to track their progress. This level of transparency empowers citizens, encouraging them to take an active role in governance.

Moreover, smart contracts can facilitate a more direct interaction between citizens and government officials, creating opportunities for public forums or feedback mechanisms that include community input.

This not only fosters a sense of ownership but also allows for more efficient allocation of resources based on actual needs.

Securing Data in Public Services

- Blockchain can enhance data security in government services.

- Privileged information remains encrypted, allowing only authorized access.

- Enhanced security leads to reduced data breaches and identity theft incidents.

Data security is a significant concern for government services, particularly with increasing cyber threats. Implementing blockchain can provide robust encryption methods that protect sensitive information. With distributed ledgers, even if one node is compromised, the rest of the network remains secure. This multi-layered security strategy enhances public confidence in government systems.

Streamlining Services through Decentralization

Decentralization is key to improving efficiency in government services. By migrating services onto a blockchain, processes that traditionally require multiple steps can be simplified. For example, property registration can become instantaneous, reducing bureaucratic delays and processing times drastically. According to recent studies, such transformations can lead to up to a 50% decrease in administrative costs.

Additionally, a decentralized approach can minimize redundancies in record-keeping, providing a single-source truth that is accessible to all authorized parties.

Global Case Studies of Blockchain in Government

Several countries have already started implementing blockchain technology in their governmental services with promising results. Estonia, for instance, has established a digital identity system that allows citizens to manage their personal information securely. This system has not only streamlined bureaucratic processes but also enhanced citizen engagement significantly.

Similarly, the city of Zug in Switzerland has introduced a blockchain-based voting system, empowering citizens to vote with greater security and transparency. These case studies illustrate how blockchain can redefine government services globally, paving the way for more innovative applications. Adopting such technologies can promote other jurisdictions to take transformative steps towards modern governance.

Read more about The Impact of Blockchain Beyond Cryptocurrency: Tech Innovations

Hot Recommendations

- Keith Urban: Country Music Chart Toppers, Latest Albums, and Tour Dates

- Conmebol Qualifiers Table: Latest Standings and Match Predictions

- Pixel 9a: Tech Innovations, In Depth Review, and Feature Highlights

- Trace Adkins: Country Music Star, Latest Hits & Fan Reactions

- OKC Thunder: Team Analysis, Season Trends, and Future Outlook

- Ivica Zubac: NBA Career Highlights, Stats & Future Potential

- Shaka Smart: Coaching Strategies, Career Highlights, and Impact on College Basketball

- 1923 Season 2 Episode 4: Deep Dive into Plot Twists and Character Development

- TR Knight: Music Career, Band History, and Latest Releases

- NVIDIA GTC 2025: Tech Innovations, Conference Highlights & Industry Trends