The Rise of Decentralized Finance (DeFi): Tech Innovations

Investors interested in this burgeoning sector should carefully assess the projects they support. Evaluating the team behind the technology, their track record, and the degree of community engagement are essential factors. Understanding the unique selling proposition of a project will provide clarity on its potential for success.

As with any investment, diversification is key. Incorporating a mix of NFTs, established DeFi protocols, and emerging Layer 2 solutions into one's portfolio can mitigate risks while maximizing potential gains. This approach will better prepare investors for the rapidly changing landscape of decentralized finance.

Security Challenges and Solutions in DeFi

Understanding the Security Risks in DeFi

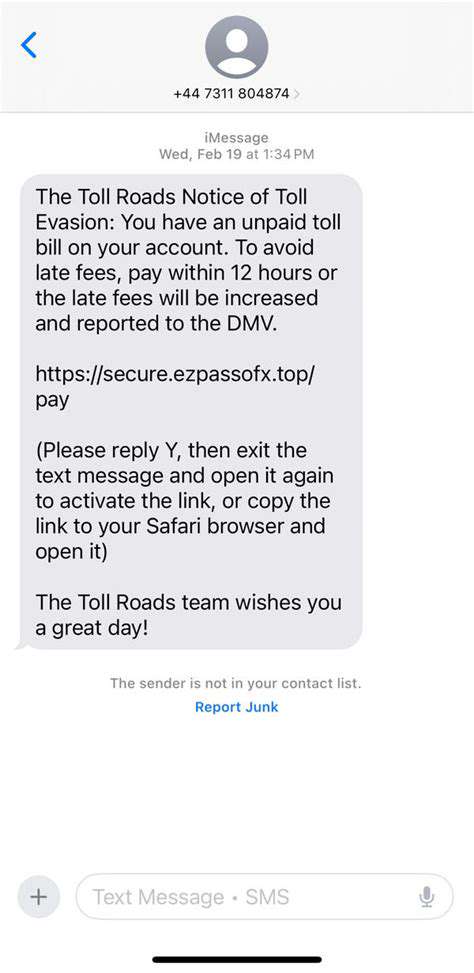

Decentralized Finance (DeFi) has witnessed significant growth, but it is not without its security risks. Many platforms are vulnerable to hacking, phishing, and other cyber threats due to their reliance on complex smart contracts. In fact, according to a report by Chainalysis, DeFi protocols accounted for over $2.2 billion in crypto losses to hacks and exploits in 2022 alone. Users must be aware of these risks to safeguard their investments.

Common issues include the exploitation of vulnerabilities in smart contracts, which can lead to significant financial losses. Improper coding practices can create loopholes, allowing malicious actors to manipulate transactions, and access users' funds. As DeFi continues to evolve, understanding these vulnerabilities is crucial for both developers and users.

Emerging Solutions to Combat Security Threats

To mitigate the security challenges in DeFi, several emerging solutions are being developed. Auditing smart contracts has become a standard practice to identify potential vulnerabilities before deployment. Many firms are now offering specialized security audits, with companies like CertiK and Quantstamp leading the charge in this space.

- Regular audits are critical for enhancing trust in DeFi protocols.

- The implementation of bug bounty programs encourages white-hat hackers to identify weaknesses.

- Insurance products are also being introduced to protect users from losses due to hacks.

The Role of Community in Increasing Security Awareness

The DeFi community plays a vital role in enhancing security awareness. Education is key, as many users entering the DeFi space may not fully understand the risks involved. Projects such as DeFi Safety promote security literacy by providing transparency and grading protocols based on their security measures. Educational initiatives can ensure that users make informed decisions and are less likely to fall victim to scams.

Future Trends in DeFi Security Measures

Looking ahead, the integration of artificial intelligence (AI) in security protocols is expected to revolutionize how DeFi projects manage risks. By utilizing AI, platforms can dynamically analyze transactions to detect anomalies in real-time, allowing for immediate action against potential threats. Stronger encryption methods and decentralized identity solutions may further enhance security, creating a safer environment for users.

The continuous evolution of security methodologies will be paramount to the sustained growth of DeFi. As regulatory scrutiny increases, it may push for more robust security protocols that emphasize user safety and compliance. This evolution is necessary to build trust in DeFi's innovative landscape and foster broader adoption among users and institutions alike.

The Future of DeFi: Empowering Individuals and Driving Financial Inclusion

Decentralized Infrastructure: The Backbone of Financial Inclusion

Decentralized Finance (DeFi) operates on blockchain technology, which creates trustless environments for transactions. This framework dramatically reduces the need for traditional banking services, which often impose high fees and stringent requirements. By utilizing smart contracts, users can engage in lending, borrowing, and trading without intermediaries, making financial services more accessible to those who were previously excluded from the system.

Research has shown that DeFi platforms have processed over $100 billion in value in a single year, as revealed in a report by DeFi Pulse. This rapid growth illustrates the increasing demand for decentralized solutions that offer lower barriers to entry while maintaining transparency and security. As a result, users in developing regions can now access a wider range of financial products simply through internet connectivity, thereby enhancing global Financial Inclusion.

Moreover, as the technology matures, innovations such as decentralized autonomous organizations (DAOs) are emerging. These entities enable community-driven governance models, where decisions are made collectively, further empowering users. This shift toward decentralized governance models ensures that individuals have a say in the protocols they use, leading to more equitable financial systems.

Mainstream Adoption: Challenges and Opportunities

While the potential of DeFi to drive financial inclusion is clear, challenges remain. One significant obstacle is regulatory uncertainty, as governments around the world grapple with how to address this innovative sector. Clear regulatory frameworks will be critical for fostering safe environments for users while protecting them against fraud and other criminal activities that may occur in pseudonymous systems.

Additionally, security risks related to smart contracts and the overall robustness of DeFi platforms continue to be a concern. For example, notable incidents of hacks have resulted in millions of dollars in losses on various protocols. As such, ongoing development of security measures and audits will be essential to build user confidence and encourage broader adoption within the DeFi ecosystem.