EZPass Scam Alert: How to Protect Yourself and What to Do Next

What to Do if You Suspect an EZPass Scam

Initial Steps

If you suspect your EZPass transponder is malfunctioning or has been compromised, the first step is to immediately stop using it. This is crucial to prevent unauthorized charges or toll violations. Discontinuing use will protect you from financial penalties and potential account issues. Furthermore, it's essential to review your EZPass account online or through the customer service portal to ensure no unusual activity has occurred.

Contact your EZPass provider or toll authority as soon as possible to report your suspicions. Early reporting allows them to investigate and take appropriate measures to prevent any further issues or fraudulent activity. This proactive communication is key to resolving the problem quickly and effectively.

EZPass Account Review

Thoroughly review your EZPass account activity for any unauthorized transactions or unusual usage patterns. Look for tolls that were not properly deducted or any entries that seem out of the ordinary. This careful examination is vital in identifying any potential discrepancies and pinpointing the source of the problem.

Checking your account statements for any discrepancies, comparing them with your recorded toll usage, and verifying the dates and times of transactions is essential. This detailed review can help pinpoint the moment your EZPass started behaving erratically.

Contacting EZPass Support

EZPass providers usually have comprehensive support channels, including phone lines, online chat, and email. Utilize these resources to describe the problem in detail, providing timestamps and transaction information. Prompt and clear communication with support is critical to a smooth resolution. They can guide you through the necessary steps to resolve your issue and ensure your account is secure.

Be prepared to provide your EZPass account number, vehicle information (if applicable), and any supporting documentation. Providing these details will expedite the support process, allowing them to address your concerns as efficiently as possible. This proactive approach will streamline the troubleshooting process.

Troubleshooting and Resolution

If the issue persists after contacting support, follow the instructions provided by the EZPass representative. This may involve a physical inspection of the transponder or performing certain actions within your account. Take detailed notes of all instructions and information provided during the support process. Careful record keeping will be valuable if further action is required.

If the problem is related to a faulty transponder, the EZPass provider might offer a replacement. Understanding the resolution process is important for ensuring a swift and effective fix. They may guide you through the replacement procedure and inform you about any potential fees or charges.

Taking Preventive Measures Against Future Scams

Understanding Common Scam Tactics to Stay Ahead

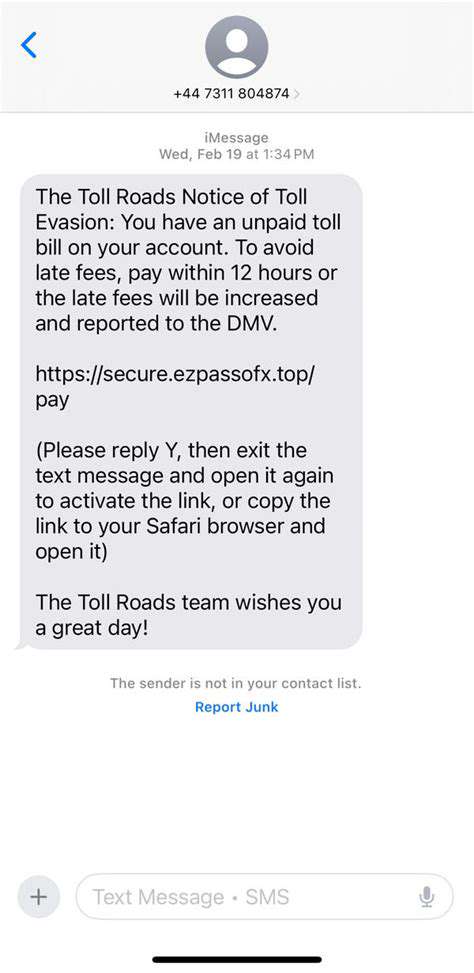

Scammers often utilize sophisticated tactics to deceive individuals into revealing sensitive information or making unwarranted payments. Recognizing common methods such as fake phone calls, fraudulent emails, and impersonation can help you identify potential threats early. Staying informed about these tactics enables you to respond appropriately and avoid falling victim to scams that are increasingly convincing and tailored to exploit vulnerabilities.

Many scammers now use spoofed caller IDs that appear to be legitimate, making it difficult to distinguish between genuine and malicious contacts. They may also create urgent scenarios, pressuring victims to act immediately without verifying the information. Understanding these psychological tricks is crucial to maintaining control and avoiding impulsive decisions that could compromise your financial security.

Identifying Red Flags in Communications

One of the most effective ways to prevent scams is to be vigilant about warning signs in communications. These include inconsistent or incorrect personal information, grammatical errors in messages, and requests for personal or financial data that seem unnecessary or unusual. Genuine organizations rarely ask for sensitive details via email or unsolicited phone calls, making skepticism a vital tool in your defense.

Always verify the source of any suspicious communication by contacting the organization directly through official channels. Do not rely on contact details provided in unsolicited messages. Recognizing these red flags allows you to act cautiously and avoid potential scams that could result in financial loss or identity theft.

Implementing Technical Safeguards on Your Devices

Utilizing security software such as firewalls, antivirus programs, and spam filters adds an essential layer of protection against scam attempts. Keeping your operating system and applications up to date ensures you have the latest security patches that protect against known vulnerabilities exploited by scammers.

Enable two-factor authentication wherever possible to add an extra step of verification for your accounts. Regularly backing up important data ensures that even if you are targeted by a scam or malware attack, your information remains safe. These technical safeguards are crucial components of a comprehensive defense strategy against future scams.

Educating Yourself and Your Family

Education plays a vital role in scam prevention. Regularly updating yourself about the latest scam trends allows you to recognize emerging threats quickly. Sharing this knowledge with family members, especially vulnerable populations like seniors, can significantly reduce their risk of falling for scams.

Organize or participate in community workshops or online webinars focused on cyber security and scam awareness. Encouraging open discussions about scam experiences helps create a more vigilant environment where everyone is prepared to identify and report suspicious activities promptly.

Maintaining Vigilance with Financial Transactions

Always scrutinize your financial statements for unauthorized or unusual transactions, which can be early indicators of scam activity. Setting up alerts for large or suspicious transactions provides real-time notifications, enabling immediate action if something appears amiss.

Be cautious when sharing your banking or credit card information online or over the phone. Use secure, encrypted websites for online transactions and avoid public Wi-Fi networks when handling sensitive financial data. Vigilance in financial dealings is key to preventing scammers from exploiting your accounts.

Developing a Response Plan for Scam Incidents

Having a clear plan of action in case you suspect or discover a scam helps you respond swiftly and effectively. This plan should include steps such as contacting your financial institutions, changing passwords, and reporting the incident to authorities or relevant agencies.

Keep a record of any suspicious communications or transactions, as this information can be valuable during investigations. Regularly review and update your response plan to adapt to new scam techniques, ensuring you are prepared for potential threats in the future.

Encouraging Community Awareness and Reporting

Community involvement enhances collective protection against scams. Sharing experiences and warning others about recent scam schemes fosters a proactive environment where scams are less likely to succeed. Encouraging local residents to report suspicious activity helps authorities respond more effectively to emerging threats.

Utilize community bulletin boards, social media, or neighborhood groups to disseminate scam alerts and prevention tips. Building a network of informed and vigilant individuals creates a strong front against scammers attempting to exploit unsuspecting victims in your area.

Read more about EZPass Scam Alert: How to Protect Yourself and What to Do Next

Hot Recommendations

- Hawks vs Hornets: NBA Game Preview, Key Players & Tactical Analysis

- Tornado Watch vs Warning: What’s the Difference and How to Stay Safe

- Alexandra Daddario: Hollywood Career, Iconic Roles & Upcoming Projects

- Wombats in Australia: Fascinating Facts, Conservation Efforts & Where to See Them

- St. Patrick’s Day 2025: History, Festivities & Modern Celebrations

- Fabian Schmidt: Profile, Career Impact & Notable Achievements

- Alex Consani: Profile, Career Highlights, and Notable Achievements

- Vivian Wilson: Profile, Career Milestones & What’s Next

- Harriet Hageman: Political Profile and Impact on National Policy

- Bryant University Basketball: Rising Stars and Season Highlights