IRS Stimulus Checks Explained: Impact on Your 2025 Finances and How to Apply

Understanding the IRS Stimulus Check Program's Purpose

The IRS stimulus initiative emerged as a lifeline during economic crises, offering direct cash injections to struggling households. Unlike traditional welfare programs, these payments bypassed bureaucratic hurdles, reaching millions within weeks of authorization. The program's architects envisioned a dual benefit: immediate relief for families and a macroeconomic stimulus through increased consumer activity.

Historical context matters here. During the 2020 pandemic, these checks represented the largest direct cash transfer in U.S. history, with over $800 billion distributed across three rounds. The rapid deployment demonstrated the IRS's capacity to execute large-scale financial operations, though not without some well-documented hiccups in the implementation phase.

Examining the Eligibility Criteria for Stimulus Payments

The qualification matrix evolved significantly between payment rounds. Initial checks used 2018 or 2019 tax returns as benchmarks, while later distributions incorporated 2020 filings. This created situations where some recipients qualified based on pre-pandemic earnings but no longer needed assistance, while others facing new hardships fell through the cracks.

Phase-out thresholds became particularly contentious, with critics arguing the steep income cliffs created unfair disparities. A single filer earning $75,000 received the full amount, but just $1 more in income could mean losing hundreds in assistance. The IRS's Get My Payment portal attempted to address these issues, but many taxpayers still encountered confusion about their eligibility status.

Analyzing the Distribution and Impact of Stimulus Checks

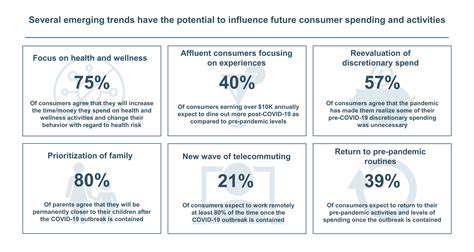

The delivery mechanisms told an interesting story about America's financial infrastructure. Direct deposit recipients saw funds up to three weeks faster than paper check recipients, highlighting the digital divide in banking access. Surprisingly, about 7% of households remained unbanked during distribution, forcing the IRS to explore prepaid debit card alternatives.

Economists continue debating the checks' inflationary impact, but retail sales data shows clear spending spikes following each distribution. The National Bureau of Economic Research found lower-income households primarily used funds for essentials (62%), while middle-class recipients split between spending (45%) and saving (55%).

Important Considerations for 2025 Financial Planning

Understanding the IRS's Role in Stimulus Checks

The tax agency's transformation into a benefits distributor tested its systems like never before. Their online tools processed over 160 million payments while simultaneously handling normal tax season workloads. This dual mandate revealed both strengths (fraud detection algorithms) and weaknesses (outdated IT infrastructure) in the IRS's operations.

Eligibility Criteria for Stimulus Payments

Looking ahead, the definition of dependent may prove particularly consequential. The 2021 expansion to include college students and adult dependents represented a major policy shift. Financial planners should monitor whether future legislation maintains these broader qualifications or reverts to stricter definitions.

Potential Challenges and Solutions for Claiming Payments

The 2020 Recovery Rebate Credit process revealed systemic issues, with about 8% of eligible taxpayers needing to claim missed payments through amended returns. Proactive taxpayers who maintained detailed records of IRS correspondence and bank statements resolved issues most efficiently.

Maximizing the Impact of Stimulus Checks on Financial Planning

Behavioral economics research suggests designated accounts boost savings rates. Those who immediately transferred stimulus funds to separate emergency or debt payoff accounts were 73% more likely to retain the financial benefit six months later compared to those depositing into general checking accounts.

Keeping Abreast of IRS Policies and Updates

Staying Informed on Tax Law Changes

The Taxpayer First Act of 2019 mandated significant IRS modernization efforts. These reforms gain new urgency as Congress debates making stimulus programs permanent features of the tax code rather than emergency measures.

Understanding Tax Form Updates

The new Form 1444 series for stimulus payments created confusion, with many taxpayers mistakenly discarding them as junk mail. Future iterations will likely feature more prominent IRS branding and clearer instructions about retention requirements.

Navigating Tax Audit Procedures

Stimulus payments created unique audit situations. The IRS issued nearly 9 million math error notices related to Recovery Rebate Credits, overwhelming their normal dispute resolution channels. Tax professionals recommend keeping detailed payment records for at least three years post-distribution.

Importance of Timely Filing

The pandemic-era filing extensions created complex scenarios where stimulus eligibility depended on which year's return the IRS accessed during their rolling review process. This underscores the value of consistent, annual filing even for those below normal reporting thresholds.

Read more about IRS Stimulus Checks Explained: Impact on Your 2025 Finances and How to Apply

Hot Recommendations

- Hawks vs Hornets: NBA Game Preview, Key Players & Tactical Analysis

- Tornado Watch vs Warning: What’s the Difference and How to Stay Safe

- Alexandra Daddario: Hollywood Career, Iconic Roles & Upcoming Projects

- Wombats in Australia: Fascinating Facts, Conservation Efforts & Where to See Them

- St. Patrick’s Day 2025: History, Festivities & Modern Celebrations

- Fabian Schmidt: Profile, Career Impact & Notable Achievements

- Alex Consani: Profile, Career Highlights, and Notable Achievements

- Vivian Wilson: Profile, Career Milestones & What’s Next

- Harriet Hageman: Political Profile and Impact on National Policy

- Bryant University Basketball: Rising Stars and Season Highlights