Freddie Mac: Housing Market Trends, Policy Updates, and Financial Insights

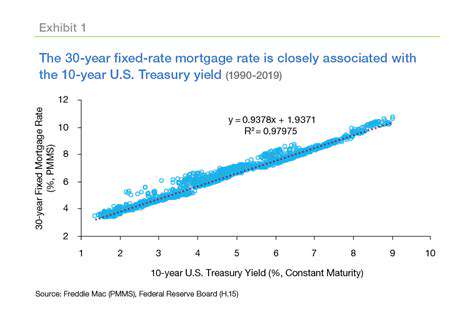

Freddie Mac's Perspective on Interest Rate Impacts

Freddie Mac's Vision for the Future of Intermediary Lending

Freddie Mac is committed to fostering a robust and innovative intermediary lending landscape. This involves supporting the development of new technologies and tools that enhance efficiency and accessibility for lenders. By empowering intermediaries, Freddie Mac aims to broaden access to mortgage financing for a wider range of borrowers. This commitment is crucial for maintaining a healthy and competitive housing market.

Their vision extends beyond simply facilitating transactions. Freddie Mac recognizes the critical role intermediaries play in connecting borrowers with appropriate mortgage products. They are actively working to improve the overall experience for both lenders and borrowers.

The Importance of Intermediary Partnerships

Freddie Mac understands the significance of strong partnerships with intermediaries. These partnerships are vital for ensuring that a wide range of borrowers have access to mortgage products that meet their specific needs and circumstances. This collaboration is essential for Freddie Mac to achieve its mission of promoting homeownership and fostering a stable housing market.

These partnerships involve a shared responsibility to provide accurate and timely information to borrowers, ensuring a smooth and transparent application process. Freddie Mac actively supports training and educational resources for intermediaries to maintain high standards.

Addressing Challenges in the Intermediary Lending Sector

The intermediary lending sector faces various challenges, including evolving regulatory landscapes, technological advancements, and shifting market dynamics. Freddie Mac is proactively working to mitigate these challenges by providing resources and support to intermediaries, ensuring they can adapt to these changes effectively.

One key area of focus is navigating the complexities of regulatory compliance. Freddie Mac provides clear guidance and resources to help intermediaries stay informed and compliant, ultimately protecting both the borrower and the lender. This is critical for maintaining the integrity of the mortgage market.

Innovations in Technology and Efficiency

Freddie Mac recognizes the need for innovative solutions to streamline the intermediary lending process. This includes exploring and implementing new technologies that improve efficiency and reduce processing times. These advancements aim to create a more streamlined and user-friendly experience for both intermediaries and borrowers.

Modernizing technology is also vital for adapting to the evolving needs of borrowers and lenders. This includes the integration of digital tools and platforms to improve the overall experience and accessibility of mortgage products.

Supporting Lender Capacity Building

Freddie Mac is dedicated to strengthening the capacity of intermediaries. This involves providing resources for training, education, and ongoing support to help lenders grow and adapt to market changes. These efforts are essential for sustaining a strong and resilient intermediary network.

Freddie Mac's support extends to providing access to advanced knowledge and resources, empowering intermediaries to make informed decisions and maintain a high level of professionalism. This includes offering mentorship and guidance for new lenders as well.

Improving Communication and Transparency

Open communication and transparency are essential components of successful intermediary partnerships. Freddie Mac emphasizes clear and consistent communication with intermediaries, providing timely updates and relevant information to support their operations. This approach fosters trust and mutual understanding.

Maintaining transparent communication channels is crucial to building strong relationships and ensuring that all parties involved in the mortgage process are well-informed. This includes clear guidelines and procedures for handling inquiries and resolving issues efficiently.

The Role of Intermediaries in Expanding Homeownership

Freddie Mac recognizes the crucial role intermediaries play in expanding homeownership opportunities. By facilitating access to mortgage financing, intermediaries enable a wider range of individuals to achieve their homeownership goals. This commitment is critical for fostering economic growth and community development.

Intermediaries are essential in connecting borrowers with the right mortgage options. Their understanding of the local market and individual needs helps tailor financing solutions for a diverse population, making homeownership a reality for many.

Read more about Freddie Mac: Housing Market Trends, Policy Updates, and Financial Insights

Hot Recommendations

- Hawks vs Hornets: NBA Game Preview, Key Players & Tactical Analysis

- Tornado Watch vs Warning: What’s the Difference and How to Stay Safe

- Alexandra Daddario: Hollywood Career, Iconic Roles & Upcoming Projects

- Wombats in Australia: Fascinating Facts, Conservation Efforts & Where to See Them

- St. Patrick’s Day 2025: History, Festivities & Modern Celebrations

- Fabian Schmidt: Profile, Career Impact & Notable Achievements

- Alex Consani: Profile, Career Highlights, and Notable Achievements

- Vivian Wilson: Profile, Career Milestones & What’s Next

- Harriet Hageman: Political Profile and Impact on National Policy

- Bryant University Basketball: Rising Stars and Season Highlights