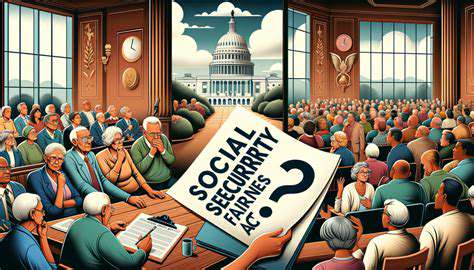

Social Security Fairness Act Benefits: What It Means for Retirees and Workers

Potential Benefits for Retirees

Financial Security and Stability

Retirement often marks a significant shift in income streams, and ensuring financial security is paramount. A well-structured retirement plan, incorporating diverse investment strategies, can provide a stable financial foundation, enabling retirees to meet their needs and enjoy their golden years without undue financial stress. Careful consideration of expenses, including healthcare costs, housing, and leisure activities, is crucial for effective budgeting and long-term financial well-being.

Diversifying income sources, such as pensions, savings accounts, and investments, can help mitigate risks and ensure a more reliable income stream. This diversification can also provide a buffer against unexpected circumstances and market fluctuations, which are inevitable in long-term financial planning.

Health and Well-being

Retirement offers a unique opportunity for improved health and well-being. With fewer work-related pressures and more free time, retirees can prioritize their health through regular exercise, healthy eating, and stress reduction techniques. This can lead to improved physical and mental health, increasing overall quality of life.

Personal Growth and Exploration

Retirement provides a unique opportunity for personal growth and exploration. Retiring individuals can pursue hobbies, interests, and passions they may have neglected during their working years. This could involve learning new skills, traveling to new destinations, or engaging in creative pursuits, fostering a sense of fulfillment and enriching their lives.

This exploration can also lead to new friendships and social connections, creating a supportive and engaging social circle. Experiencing new things can also keep the mind active and engaged, which is important for cognitive health and overall well-being in later life.

Social Connections and Community Engagement

Retirement often involves a shift in social circles, and maintaining strong social connections is crucial. Engaging in activities with like-minded individuals, joining clubs, volunteering in the community, or simply nurturing existing relationships can foster a sense of belonging and combat feelings of isolation.

Strong social connections can provide emotional support, reduce stress, and promote a greater sense of purpose and fulfillment during retirement. This can be achieved through various avenues, including community involvement, joining groups with shared interests, and maintaining close relationships with family and friends.

Purpose and Meaning in Life

Finding purpose and meaning in life is a significant aspect of retirement. For many retirees, this involves a shift in focus from career goals to personal fulfillment and contributing to something larger than themselves. This can take various forms, such as volunteering, mentoring, pursuing a passion project, or engaging in activities that contribute to the well-being of others.

Activities that foster a sense of purpose can provide a strong sense of fulfillment and a greater sense of purpose. This can enhance self-esteem and contribute to overall happiness and well-being.

Travel and Exploration

Retirement often provides the opportunity for travel and exploration. With more time and flexibility, retirees can explore new destinations, experience different cultures, and create lasting memories. Experiencing new places and cultures can broaden perspectives, foster appreciation for diversity, and create enriching personal journeys.

Travel can be a powerful tool for personal growth, fostering self-discovery and a deeper understanding of the world. This exploration can enhance a retiree's intellectual curiosity and contribute to their overall well-being.

Addressing the Future Sustainability of Social Security

Ensuring Long-Term Financial Viability

The long-term sustainability of Social Security hinges on a delicate balance between the contributions of current workers and the benefits paid to retirees. A critical aspect of this balance is understanding and addressing the projected shortfall in funding. This shortfall, driven by an aging population and a lower birth rate, necessitates proactive measures to ensure that future generations can rely on the program. We need to explore innovative approaches to funding, potentially including adjustments to benefit formulas, increasing the retirement age, or raising the cap on taxable earnings. These measures, while potentially controversial, are crucial for maintaining the program's integrity and ensuring its continued relevance.

Careful consideration must also be given to the potential impact of economic downturns and unforeseen events on the program's finances. Economic shocks, such as recessions or global crises, can significantly affect worker contributions and benefit payments. Developing robust contingency plans and exploring alternative investment strategies are important steps towards mitigating these risks and enhancing the program's resilience.

Promoting Equitable Benefit Distribution

Social Security's design, while fundamentally intended to provide a safety net, has certain inherent biases. Understanding and addressing these biases is crucial to ensuring the program's fairness. For example, workers in lower-paying jobs often receive smaller benefits relative to their contributions, while those with higher incomes accumulate larger nest eggs. A key area of focus should be the development of strategies to address these disparities and ensure a more equitable distribution of benefits. This could involve adjustments to the benefit formula or the creation of supplementary programs to support those with the lowest incomes.

Another important aspect of equitable distribution relates to the varying needs of different demographic groups. Different groups may require varying levels of support, and a one-size-fits-all approach might not adequately address the needs of all populations. Understanding the unique challenges and needs of these groups is essential to ensuring that Social Security serves as a truly effective safety net for all. This includes considering the needs of individuals with disabilities, those caring for dependents, and those facing significant economic hardship.

Modernizing Social Security for the 21st Century

To ensure the long-term sustainability and fairness of Social Security, it's essential to modernize the program for the 21st-century workforce. The evolving nature of work, with the rise of the gig economy and remote work arrangements, demands that we re-evaluate how we collect contributions from various employment sectors. This includes implementing strategies to capture contributions from the increasing number of independent contractors and freelancers. Modernization also entails exploring new technologies to streamline administrative processes, reduce costs, and enhance the overall efficiency of the program.

Furthermore, we need to improve communication and outreach efforts to ensure that all eligible individuals understand their rights and responsibilities concerning Social Security. This should include providing clear and accessible information about the program's benefits, eligibility requirements, and potential changes. Improved outreach can help mitigate misunderstandings and ensure that the program effectively serves the needs of its constituents.

Adapting Social Security to accommodate the evolving needs of the modern workforce requires careful consideration of emerging issues. This includes understanding how technology and automation might impact employment patterns and income levels, and developing strategies to ensure that the program remains relevant and responsive to these changes. This necessitates ongoing research, data analysis, and collaborative discussions involving stakeholders from across the spectrum.

The evolving nature of healthcare and the rising costs of long-term care are also important considerations. Potential adjustments to the program to accommodate these factors could involve offering incentives for early retirement planning or incorporating healthcare benefits into the structure. Comprehensive solutions require careful planning to avoid unintended consequences.

Incorporating these modern considerations into the program will require a multifaceted approach involving policy adjustments, technological advancements, and improved communication strategies. This will necessitate ongoing dialogue and collaboration among policymakers, experts, and the public to ensure that the program remains a vital component of our social safety net well into the future.

Read more about Social Security Fairness Act Benefits: What It Means for Retirees and Workers

Hot Recommendations

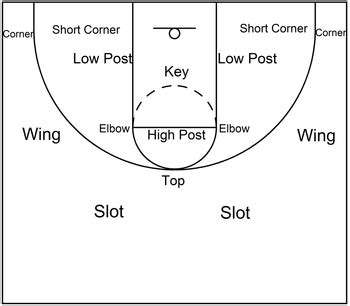

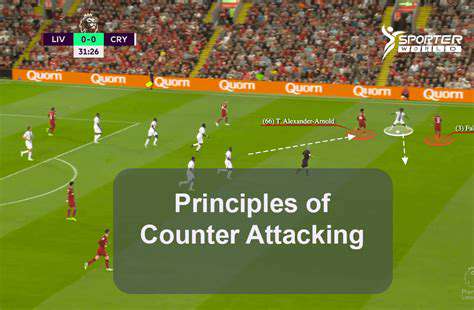

- Hawks vs Hornets: NBA Game Preview, Key Players & Tactical Analysis

- Tornado Watch vs Warning: What’s the Difference and How to Stay Safe

- Alexandra Daddario: Hollywood Career, Iconic Roles & Upcoming Projects

- Wombats in Australia: Fascinating Facts, Conservation Efforts & Where to See Them

- St. Patrick’s Day 2025: History, Festivities & Modern Celebrations

- Fabian Schmidt: Profile, Career Impact & Notable Achievements

- Alex Consani: Profile, Career Highlights, and Notable Achievements

- Vivian Wilson: Profile, Career Milestones & What’s Next

- Harriet Hageman: Political Profile and Impact on National Policy

- Bryant University Basketball: Rising Stars and Season Highlights