Tesla Stock Price Today: Market Analysis, Trends, and Investment Strategies

Navigating Tesla's Investment Landscape

The Long Game: Growth Investing

Tesla's future depends on its ability to stay ahead in the EV race while venturing into energy storage and AI-driven mobility. The company's massive R&D spending - particularly on next-gen batteries and Full Self-Driving tech - could make or break its competitive edge. Savvy investors watch Tesla's Gigafactory expansions like hawks, knowing production scalability often determines success in this capital-intensive industry. Meanwhile, Elon Musk's unconventional leadership style continues to polarize Wall Street analysts.

Here's what most investors miss: Tesla's real advantage might lie in its vertical integration. While competitors rely on suppliers, Tesla controls everything from battery production to software development. This unique approach could prove invaluable as the industry matures.

Value Hunting in a Growth Stock

Finding value in Tesla requires looking beyond traditional metrics. The company's industry-leading gross margins (often 25%+ in automotive) tell part of the story, but the real magic happens in its software monetization. Those $10,000 Full Self-Driving packages? They're nearly pure profit. However, investors should scrutinize warranty reserves and depreciation policies - these accounting choices significantly impact reported earnings.

Seasoned value hunters pay special attention to Tesla's energy storage business. While overshadowed by vehicle sales, this segment's gross margins recently surpassed the automotive division. Could this become Tesla's hidden cash cow?

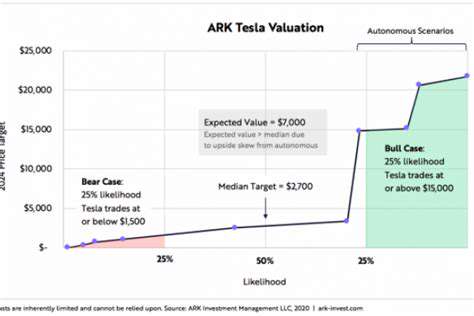

Riding the Volatility Wave

Tesla's stock behaves like no other in the S&P 500. The 50-day moving average serves as a psychological battleground for traders, while options activity frequently signals coming volatility. Pro tip: Watch for unusual options volume at key strike prices - these often precede major moves. Remember March 2020 when Tesla shares doubled in weeks? That wasn't fundamentals; it was gamma squeezing in the options market.

Successful traders pair technical analysis with sentiment gauges. The Tesla Investor Roundtable subreddit sometimes moves markets more than earnings reports. When retail enthusiasm peaks while institutional ownership dips, smart money gets cautious.

The Dividend Question

Let's be clear: if you need quarterly dividend checks, Tesla isn't your stock. The company reinvests every dollar into growth initiatives, from Cybertruck production to Optimus robot development. However, creative investors can manufacture their own dividends through strategic covered call writing - just be prepared for assignment risk during Tesla's famous rallies.

Interestingly, Tesla's cash position ($26B+ as of Q1 2023) could theoretically support a dividend. But with Musk prioritizing growth over shareholder returns, don't hold your breath.

Crunching the Numbers

Quant analysts love Tesla's clean datasets - no legacy ICE business muddying the financials. Key metrics to watch: - Delivery growth vs. production capacity- Regulatory credit contribution (declining is actually good - means core business is strengthening)- Free cash flow conversion

The most revealing number? Research spend as percentage of revenue. While legacy automakers hover around 3-5%, Tesla consistently exceeds 10%, signaling its true tech company DNA.

The ESG Paradox

Tesla presents a fascinating ESG case study. On one hand, its products directly reduce carbon emissions. On the other, governance concerns (from board independence to Musk's Twitter antics) give pause. The Berlin factory's water usage debates highlight how even green companies face environmental scrutiny. ESG investors should note: Tesla was booted from the S&P 500 ESG Index in 2022 despite its climate impact.

The real question isn't whether Tesla is perfect, but whether it's driving meaningful change faster than traditional automakers. That's the ESG calculus that matters.

Read more about Tesla Stock Price Today: Market Analysis, Trends, and Investment Strategies

Hot Recommendations

- Hawks vs Hornets: NBA Game Preview, Key Players & Tactical Analysis

- Tornado Watch vs Warning: What’s the Difference and How to Stay Safe

- Alexandra Daddario: Hollywood Career, Iconic Roles & Upcoming Projects

- Wombats in Australia: Fascinating Facts, Conservation Efforts & Where to See Them

- St. Patrick’s Day 2025: History, Festivities & Modern Celebrations

- Fabian Schmidt: Profile, Career Impact & Notable Achievements

- Alex Consani: Profile, Career Highlights, and Notable Achievements

- Vivian Wilson: Profile, Career Milestones & What’s Next

- Harriet Hageman: Political Profile and Impact on National Policy

- Bryant University Basketball: Rising Stars and Season Highlights