United Healthcare Explained: Benefits, Coverage & Policy Updates

Understanding UnitedHealthcare's Coverage

UnitedHealthcare is a major player in the U.S. health insurance market, offering a wide range of plans to individuals, families, and employers. Their diverse offerings cater to various health needs and budgets, from basic health insurance to comprehensive plans with extensive benefits. Understanding the specific coverage options available within UnitedHealthcare is crucial for consumers to ensure they have the right plan to meet their individual and family needs. This involves carefully reviewing the specifics of each plan's benefits, including deductibles, co-pays, and out-of-pocket maximums.

Navigating the different types of plans offered by UnitedHealthcare, such as HMOs, PPOs, and POS plans, is essential for making an informed decision. Each plan type has its own unique features regarding provider networks, cost-sharing, and access to care. Understanding these differences allows individuals to select a plan that best aligns with their healthcare preferences and lifestyle. Thorough research and comparison are key to finding the most suitable UnitedHealthcare plan.

UnitedHealthcare's Benefits and Services

UnitedHealthcare offers a broad spectrum of benefits, encompassing preventive care, hospitalizations, specialist visits, and prescription drugs. The specific benefits available can vary significantly depending on the chosen plan. In-depth analysis of these benefits, including coverage for routine checkups, vaccinations, and chronic disease management programs, is necessary for understanding the comprehensive nature of the insurance. This is vital for individuals looking to ensure their healthcare needs are adequately addressed under the plan.

UnitedHealthcare also provides access to a range of services beyond basic coverage, such as telehealth options, mental health support, and assistance with finding doctors. These additional services can improve the overall healthcare experience and are important factors to consider when selecting a plan. The availability and extent of these supplementary services often differ between various plans, highlighting the importance of detailed plan comparisons.

UnitedHealthcare's commitment to improving members' health extends beyond just coverage. They often offer resources and tools for managing chronic conditions, promoting wellness, and encouraging preventative care. These initiatives can contribute significantly to better health outcomes for members. Understanding how these resources are utilized and how they can be incorporated into an overall healthcare strategy is critical for maximizing the benefits of the chosen plan.

UnitedHealthcare's Cost and Value Proposition

The cost of UnitedHealthcare plans varies considerably depending on several factors, including location, plan type, and the specific benefits selected. Understanding the cost structure, including premiums, deductibles, and co-pays, is crucial for evaluating the value proposition of a particular plan. Careful comparison of costs across different plans is essential to ensure that the chosen plan aligns with one's budget and financial capabilities.

UnitedHealthcare's value proposition extends beyond just cost. The comprehensive nature of their coverage, along with the supplementary services and resources they offer, can provide significant value to members. Factors such as provider networks, access to specialists, and the ease of utilization of services should be considered when evaluating the overall worth of a UnitedHealthcare plan. Understanding the value proposition requires a thorough analysis of the plan's features in relation to the individual's or family's specific healthcare needs.

Types of UnitedHealthcare Plans

UnitedHealthcare HMO Plans

UnitedHealthcare HMO (Health Maintenance Organization) plans typically require members to choose a primary care physician (PCP) from a network of doctors. This PCP coordinates your care and manages referrals to specialists within the network. HMO plans often have lower premiums than other plans, but you're limited to seeing doctors and specialists within their network without incurring extra costs. This can be a good choice for individuals who prefer a coordinated care model and value cost-effectiveness.

Choosing a PCP is a crucial step in utilizing an HMO plan. The PCP serves as your primary point of contact for all medical needs and will coordinate care with specialists if necessary. This focus on preventative care and coordinated care is a key feature of HMO plans.

UnitedHealthcare PPO Plans

UnitedHealthcare PPO (Preferred Provider Organization) plans offer more flexibility than HMO plans. You can see any doctor or specialist, in or out of the network, but you'll pay more for care outside the network. PPOs usually have broader provider networks, meaning you have more choices for doctors. This flexibility can be beneficial for individuals who want more control over their healthcare choices.

While PPOs offer greater choice, costs can vary depending on whether you utilize in-network or out-of-network providers. Understanding your plan's coverage details is crucial for making informed decisions about healthcare utilization.

UnitedHealthcare POS Plans

UnitedHealthcare POS (Point of Service) plans blend elements of both HMO and PPO plans. This hybrid approach offers a balance between the coordinated care of an HMO and the wider choice of a PPO. Members can choose a PCP from a network of doctors, but they also have the option of seeing out-of-network providers. This gives you a bit more flexibility compared to a strict HMO plan.

UnitedHealthcare Catastrophic Plans

Catastrophic plans from UnitedHealthcare are designed for individuals who anticipate needing high levels of medical care in the future. These plans often have high deductibles, but they can offer significant protection against high medical expenses. Catastrophic plans are often a good choice for individuals who are healthy but want to have protection from significant healthcare costs. These plans often provide substantial coverage once the deductible is met.

Because of their high deductibles, catastrophic plans are often more affordable than other health plans. However, it's important to note that the high deductible can make these plans less desirable for those who anticipate frequent or significant medical needs.

UnitedHealthcare Special Needs Plans

UnitedHealthcare offers special needs plans for people with specific health conditions or chronic illnesses. These plans may include enhanced benefits or specialized care coordination to better address the needs of these individuals. These plans are tailored to the unique requirements of specific health conditions, providing specialized care and support. They often have pre-approved providers and care management to ensure appropriate health outcomes.

UnitedHealthcare special needs plans can be crucial for individuals who require particular care management strategies or specialized care coordination. These plans can help patients with complex medical needs manage their health conditions more effectively.

UnitedHealthcare Medicare Plans

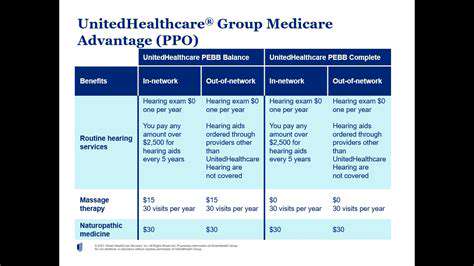

UnitedHealthcare offers a variety of plans designed specifically for Medicare beneficiaries. These plans typically include both medical and prescription drug coverage to meet the comprehensive healthcare needs of seniors. These plans can often help manage costs and cover the extensive needs of Medicare recipients. Understanding the different types of Medicare plans offered by UnitedHealthcare is essential for selecting the best option to suit individual needs.

Medicare plans from UnitedHealthcare often include a variety of options, such as HMO, PPO, and POS plans. Careful comparison of these plans based on individual needs and preferences is crucial for choosing the best coverage.

Read more about United Healthcare Explained: Benefits, Coverage & Policy Updates

Hot Recommendations

- Hawks vs Hornets: NBA Game Preview, Key Players & Tactical Analysis

- Tornado Watch vs Warning: What’s the Difference and How to Stay Safe

- Alexandra Daddario: Hollywood Career, Iconic Roles & Upcoming Projects

- Wombats in Australia: Fascinating Facts, Conservation Efforts & Where to See Them

- St. Patrick’s Day 2025: History, Festivities & Modern Celebrations

- Fabian Schmidt: Profile, Career Impact & Notable Achievements

- Alex Consani: Profile, Career Highlights, and Notable Achievements

- Vivian Wilson: Profile, Career Milestones & What’s Next

- Harriet Hageman: Political Profile and Impact on National Policy

- Bryant University Basketball: Rising Stars and Season Highlights