NKE Stock: Athletic Apparel Market Trends and Investment Analysis

Key Market Trends Shaping the Future

Technological Advancements in Forecasting

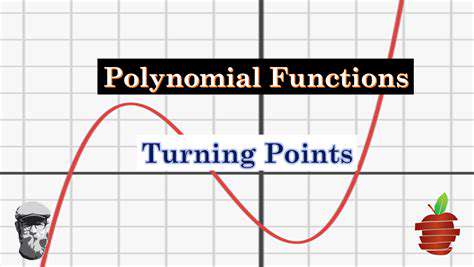

Rapid advancements in artificial intelligence (AI) and machine learning (ML) are revolutionizing forecasting methods. These technologies allow for the analysis of vast datasets and the identification of complex patterns that would be impossible for human analysts to discern. Predictive models powered by AI can provide significantly more accurate and timely forecasts, leading to better decision-making in various sectors. Furthermore, the integration of real-time data streams enhances the responsiveness and adaptability of forecasting systems.

The development of sophisticated algorithms is enabling more accurate and nuanced forecasts in diverse fields. From weather patterns to financial markets, these algorithms can identify subtle trends and predict outcomes with a higher degree of precision compared to traditional methods. This capability is particularly valuable in sectors requiring rapid and informed decision-making.

The Rise of Data-Driven Decision Making

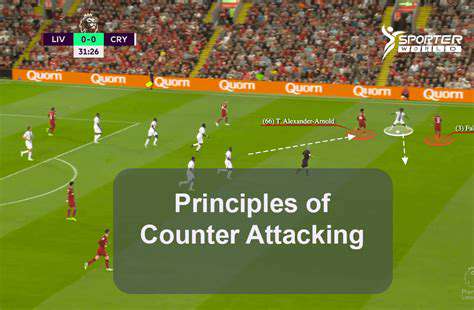

Businesses are increasingly recognizing the crucial role of data in informing strategic decisions. Data-driven insights are now essential for optimizing operations, identifying market opportunities, and mitigating risks. The availability of comprehensive and readily accessible data sources empowers businesses to make more informed choices across various facets of their operations.

The ability to leverage data effectively is becoming a key differentiator in today's competitive landscape. Organizations that effectively utilize data analytics for forecasting can gain a significant competitive edge, enabling them to anticipate market shifts and adapt to changing conditions with greater agility.

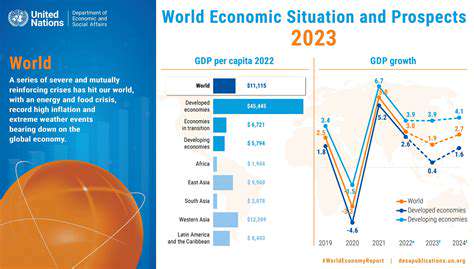

Globalization and its Impact on Forecasting

Globalization has created interconnected markets, leading to significant challenges and opportunities for forecasting. The intricate interplay of global economic factors, geopolitical events, and cultural nuances requires sophisticated forecasting models capable of capturing these complexities. Accurate predictions in this environment require a nuanced understanding of diverse market dynamics and the ability to anticipate the ripple effects of global events.

International trade agreements, currency fluctuations, and geopolitical tensions are just a few of the factors that significantly influence global markets. Forecasting models must account for these intricate variables to provide reliable predictions and support informed decision-making in the face of global uncertainty. The ability to assess the impact of global events on specific markets is becoming increasingly crucial for businesses and investors alike.

Focus on Sustainability and Ethical Considerations

Growing awareness of environmental concerns and ethical considerations is shaping forecasting practices. Businesses are increasingly incorporating sustainability metrics into their forecasts, recognizing the importance of long-term environmental impact. This shift is driving the development of sustainable forecasting models that consider the environmental footprint of products and processes. Forecasting models need to account for the environmental impact of decisions and future trends.

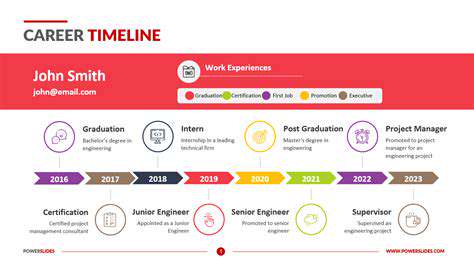

Demand for Real-Time and Adaptive Forecasting

The need for real-time and adaptable forecasting models is gaining prominence in today's dynamic environment. The speed and volume of data generated in various sectors necessitate systems capable of processing information instantaneously and adjusting forecasts accordingly. Businesses require forecasting models that can quickly incorporate new data points and adapt to changing conditions. Adaptability is paramount in today's rapidly evolving marketplace.

The ability to react quickly to unexpected events and adjust forecasts accordingly is crucial for success. This flexibility is essential in sectors like finance, supply chain management, and healthcare, where rapid response to market fluctuations or unforeseen events can significantly impact outcomes. Real-time forecasting capabilities are empowering organizations to make more agile decisions and maintain a competitive edge in the face of uncertainty.

Read more about NKE Stock: Athletic Apparel Market Trends and Investment Analysis

Hot Recommendations

- Hawks vs Hornets: NBA Game Preview, Key Players & Tactical Analysis

- Tornado Watch vs Warning: What’s the Difference and How to Stay Safe

- Alexandra Daddario: Hollywood Career, Iconic Roles & Upcoming Projects

- Wombats in Australia: Fascinating Facts, Conservation Efforts & Where to See Them

- St. Patrick’s Day 2025: History, Festivities & Modern Celebrations

- Fabian Schmidt: Profile, Career Impact & Notable Achievements

- Alex Consani: Profile, Career Highlights, and Notable Achievements

- Vivian Wilson: Profile, Career Milestones & What’s Next

- Harriet Hageman: Political Profile and Impact on National Policy

- Bryant University Basketball: Rising Stars and Season Highlights