MU Stock: Market Analysis, Earnings Report, and Investment Outlook

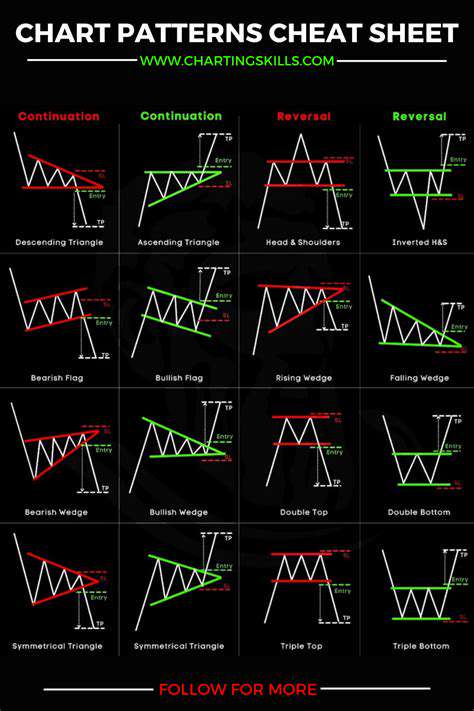

Technical Analysis of MU Stock: Chart Patterns and Indicators

Technical Analysis of MU Stock: Identifying Potential Trends

MU stock, a prominent player in the technology sector, has exhibited fluctuating trends in recent times. A comprehensive technical analysis is crucial to understanding these movements and potentially identifying future price directions. This analysis considers various indicators, including price charts, volume, and momentum oscillators, to provide a well-rounded perspective on the stock's current state.

Analyzing historical data and recent price patterns provides insights into potential future price action. By carefully examining the stock's price charts, we can identify key support and resistance levels, which are crucial for understanding potential price reversals.

Price Action and Support/Resistance Levels

The price action of MU stock has shown periods of consolidation and significant price swings. Identifying support and resistance levels is critical in determining the strength of buying and selling pressures. Support levels represent price points where buyers typically step in, preventing further downward movement, while resistance levels are price points where sellers often accumulate, hindering upward momentum.

Identifying these levels is vital for developing trading strategies. A strong break above a significant resistance level, coupled with high trading volume, may signal a bullish trend, whereas a breach of a critical support level accompanied by a notable decline in volume might suggest a bearish reversal.

Volume Analysis: Measuring Market Sentiment

Volume analysis provides valuable insights into market sentiment surrounding MU stock. High trading volume during periods of price movement often indicates significant investor interest and potentially stronger price trends. Conversely, low volume during periods of price change may suggest a lack of conviction among traders, potentially indicating a weaker trend.

Momentum Oscillators: Evaluating Current Momentum

Momentum oscillators, such as the RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence), are essential tools for evaluating the current momentum of MU stock. These indicators can help us identify potential overbought or oversold conditions, which may signal potential trend reversals.

Analyzing these oscillators alongside other technical indicators enhances the accuracy of the analysis and provides a more complete picture. Identifying potential divergences between price and momentum indicators can provide valuable insights into potential trend reversals.

Moving Averages: Identifying Trend Direction

Moving averages are crucial for identifying the overall trend direction of MU stock. Different moving averages (e.g., 20-day, 50-day, 200-day) provide different perspectives on the underlying trend. By considering the relationship between these moving averages, we can gain a better understanding of the stock's short-term and long-term momentum.

A rising trend is often signaled by moving averages converging upwards, whereas a falling trend is often indicated by moving averages converging downwards. These trend lines provide a framework for potentially anticipating future price movements.

Technical Indicators: Confirmation and Validation

Combining multiple technical indicators, such as volume, momentum oscillators, and moving averages, creates a more comprehensive picture of MU stock's potential future performance. Using multiple indicators enhances the reliability of the analysis, as a single indicator may not always accurately predict future price movements.

Key Considerations and Limitations

Technical analysis is a valuable tool, but it's crucial to recognize its limitations. Past performance is not indicative of future results, and market conditions can change rapidly. External factors, such as economic news and company-specific events, can significantly impact stock prices and potentially invalidate technical analysis predictions.

It's essential to consider these limitations when making investment decisions. Conducting thorough research, including fundamental analysis, and seeking professional financial advice is crucial for informed investment strategies.

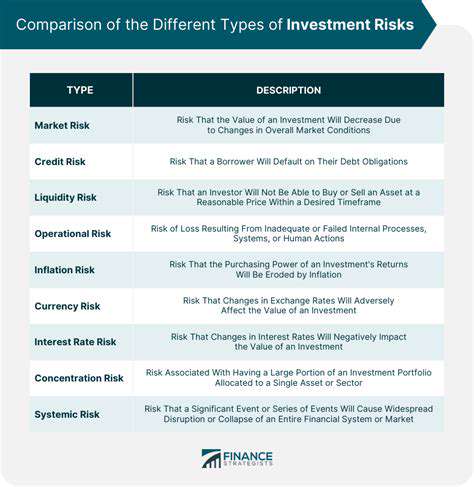

Investment Outlook and Potential Risks

Investment Outlook and Potential Risks

The current investment outlook presents a complex interplay of factors. Economic growth projections are showing signs of moderation, but remain positive overall. This suggests a potential for sustained returns in some sectors, while others might face headwinds due to shifting market dynamics. Understanding these nuanced trends is crucial for investors to make informed decisions.

Several key economic indicators, such as inflation rates and interest rate adjustments, will play a significant role in shaping the investment landscape. Changes in these indicators can dramatically shift investor sentiment and potentially impact returns across different asset classes. Investors need to closely monitor these indicators to gauge the potential risks and opportunities.

Potential for Growth in Specific Sectors

Certain sectors are demonstrating promising growth potential. Technological advancements are driving innovation in areas like renewable energy and artificial intelligence, creating opportunities for substantial returns. However, competition within these sectors is fierce, and successful investment requires careful consideration of market trends and emerging technologies.

The healthcare sector also presents potential for growth, driven by an aging global population and increasing demand for medical services. However, regulatory changes and evolving patient preferences could significantly impact the profitability of specific companies within this sector. Investors need to conduct thorough due diligence to assess the long-term viability of investments in this area.

Risk Mitigation Strategies

Given the inherent volatility of the investment market, implementing robust risk mitigation strategies is essential. Diversification across various asset classes can help mitigate potential losses in any single sector. This approach can help balance portfolio returns while also reducing the overall risk exposure.

Thorough research and due diligence are crucial steps for mitigating risks. Understanding the financial health and performance history of potential investments helps investors make informed decisions. A well-defined investment strategy, including clear risk tolerance levels, will guide your decision-making process and help you stay on track. Regular portfolio reviews and adjustments are equally important to address changing market conditions and adapt to evolving investment opportunities.

Evaluating Long-Term Trends and Opportunities

Long-term investment strategies should consider emerging trends and opportunities. Factors like demographic shifts, technological advancements, and environmental concerns will significantly influence the investment landscape in the future. Understanding these trends allows investors to identify potential areas of growth and make informed investment decisions.

Analyzing market data and conducting thorough research are vital steps for evaluating long-term trends. Tracking industry-specific news, attending conferences, and engaging with industry experts can provide valuable insights. Proactive engagement with these elements will help you uncover hidden opportunities and effectively navigate the complexities of the investment market.

Read more about MU Stock: Market Analysis, Earnings Report, and Investment Outlook

Hot Recommendations

- Hawks vs Hornets: NBA Game Preview, Key Players & Tactical Analysis

- Tornado Watch vs Warning: What’s the Difference and How to Stay Safe

- Alexandra Daddario: Hollywood Career, Iconic Roles & Upcoming Projects

- Wombats in Australia: Fascinating Facts, Conservation Efforts & Where to See Them

- St. Patrick’s Day 2025: History, Festivities & Modern Celebrations

- Fabian Schmidt: Profile, Career Impact & Notable Achievements

- Alex Consani: Profile, Career Highlights, and Notable Achievements

- Vivian Wilson: Profile, Career Milestones & What’s Next

- Harriet Hageman: Political Profile and Impact on National Policy

- Bryant University Basketball: Rising Stars and Season Highlights

![Bud Cauley: Rising Talent Profile and His Impact on [Relevant Field]](/static/images/24/2025-05/LookingAhead3AFutureProspects.jpg)