Income Driven Repayment for Student Loans: What Borrowers Need to Know

Contents

IDR plans adjust payments based on income and family size.

Eligibility depends on financial need and loan status.

Payments are calculated using discretionary income guidelines.

Borrowers can qualify for loan forgiveness after 20-25 years.

IDR plans allow flexibility during financial hardships.

Enrollment requires specific income documentation and annual recertification.

Long-term implications include higher total interest over time.

Consider alternatives if financially stable, such as refinancing.

What Are Income-Driven Repayment Plans?

Understanding Income-Driven Repayment Plans

If you're struggling with student loans, income-driven repayment (IDR) plans could be a lifeline. These plans don’t force you into a one-size-fits-all payment structure. Instead, they adjust your monthly payments based on what you actually earn and how many dependents you support. For example, a teacher earning $45,000 with two kids would pay far less than a single software engineer making $80,000. This flexibility helps prevent loans from derailing your budget when life throws curveballs.

Eligibility Criteria for IDR Plans

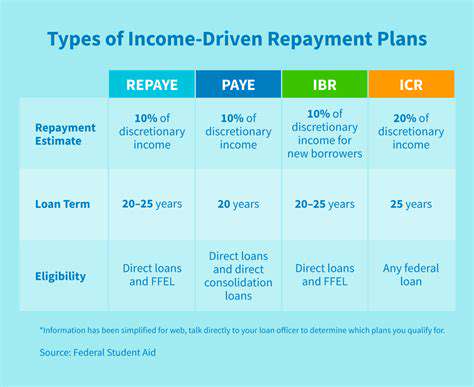

Not everyone qualifies for these plans. To be eligible, you’ll need to prove financial hardship through documents like tax returns or recent pay stubs. Your loans must also be federal—private loans don’t count. For instance, if you’ve defaulted on past payments, you’ll need to get your loans back into good standing first. Each IDR variant (like IBR or PAYE) has slightly different rules, so double-check which ones align with your loan types and income level.

How Payments Are Calculated

Here’s where it gets technical: payments hinge on your discretionary income, which is basically what’s left after covering basic living costs. The government calculates this by comparing your income to 150% of the poverty line for your household size. Let’s say you earn $40,000 in Texas with a family of three. Using 2023 guidelines, 150% of the poverty line is $33,165. Your discretionary income would be $6,835, and your payment might be 10% of that—about $57 a month. This math explains why two people with identical salaries might pay wildly different amounts.

Forgiveness Benefits of IDR Plans

Sticking with an IDR plan for 20-25 years can lead to loan forgiveness, but there’s a catch. The IRS currently treats forgiven amounts as taxable income. Imagine owing $50,000 that gets wiped out—you could suddenly owe $12,000+ in taxes. This tax bomb surprises many borrowers, so start saving early if forgiveness is part of your strategy. Also, track your qualifying payments meticulously; missing annual recertifications could reset your progress.

Advantages of Choosing an IDR Plan

Beyond lower payments, IDR plans act as a safety net during crises. Lost your job? Your payment could drop to $0 temporarily. Had a baby? Your family size adjustment might slash next year’s bill. This adaptability is why IDR plans are crucial for public servants, gig workers, and anyone with unstable income. Plus, staying current protects your credit score—a default can linger on reports for seven years.

How to Enroll in an IDR Plan

Enrolling is simpler than most think. Start at the Federal Student Aid site—you’ll upload pay stubs, tax forms, and household details. Pro tip: apply during tax season when documents are handy. If your income dropped recently (say, due to a career change), use your latest pay stub instead of last year’s taxes to lock in lower payments faster. And mark your calendar for annual recertification—missing deadlines can spike payments by hundreds of dollars.

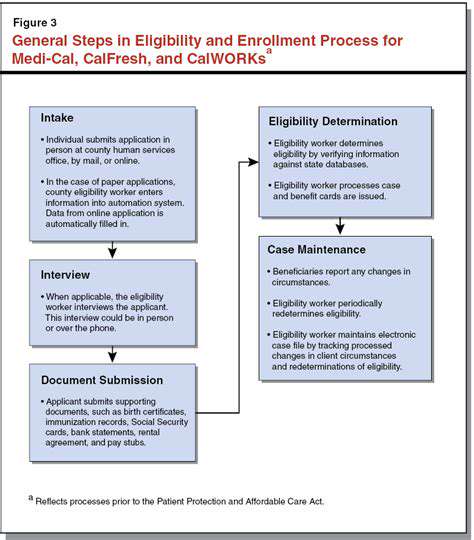

Eligibility and Enrollment Process

Understanding Eligibility Criteria

Federal loans like Direct Loans and PLUS Loans qualify, but FFEL Program loans require consolidation first. Your income must fall below thresholds that vary by state and family size. For example, a single borrower in California earning under $25,000 might qualify for $0 payments under REPAYE. Use the Education Department’s online calculator—it’s shockingly accurate—to see where you stand before applying.

Application Steps for IDR Plans

- Gather 3 months of pay stubs or last year’s tax return

- Log into studentaid.gov using your FSA ID

- Select Apply for an Income-Driven Plan and follow prompts

Beware of outdated advice—the process moved entirely online in 2022. Avoid paper forms; they take 6-8 weeks longer. If you’re married, note that some plans (like PAYE) exclude spousal income if you file taxes separately. This loophole can save couples thousands annually—consult a student loan attorney if unsure.

Annual Recertification Process

Recertifying isn’t optional. Servicers like Nelnet or MOHELA will email reminders, but set your own phone alert too. If you miss the deadline, payments revert to standard 10-year amounts—a disaster for budgets. Pro tip: Recertify 60 days early to avoid processing delays. Had a pay raise? Consider switching plans—REPAYE always includes spousal income, while IBR doesn’t if you file separately.

Benefits of Income-Driven Repayment Plans

Flexibility in Payments

IDR plans shine during life transitions. Going back to school? Payments pause during deferment. Had a medical emergency? Submit updated income docs mid-year to lower payments immediately. Unlike fixed plans, IDR adapts to your reality—not the other way around. Just keep your servicer in the loop about major changes; they can’t guess your situation.

Potential for Loan Forgiveness

Combining IDR with Public Service Loan Forgiveness (PSLF) is the holy grail. Work for a nonprofit or government? Make 120 qualifying payments (about 10 years) while on an IDR plan, and the rest vanishes tax-free. Teachers in Title I schools, nurses at public hospitals—this is how smart borrowers erase six-figure debts. Track payments religiously and submit employment certifications yearly to stay on course.

Considerations and Potential Drawbacks

Long-Term Interest Costs

Lower payments mean loans linger longer, accruing interest daily. A $60,000 loan at 6% could grow to $90,000+ over 20 years on IDR. Use the avalanche method—put extra cash toward highest-interest loans—to minimize this bleed. Refinancing might help, but you’ll lose federal protections. Run the numbers carefully before deciding.

Tax Implications of Forgiveness

Unless Congress changes the law, forgiven amounts under IDR count as taxable income. Forgiven $80,000? That’s like getting an $80,000 bonus—the IRS wants its cut. Start stashing 20-25% of the forgiven amount in a savings account now. Some states like California don’t tax forgiven loans, but others like Mississippi do. Consult a tax pro in your state to avoid nasty surprises.

Read more about Income Driven Repayment for Student Loans: What Borrowers Need to Know

Hot Recommendations

- Duke Basketball: A Legacy of Excellence – Season Recap and Future Stars

- One Battle After Another: Stories of Overcoming Challenges and Triumphs

- MLB Games Tonight: Schedule, Scores & Key Matchups to Watch

- Men’s March Madness 2025: Expert NCAA Bracket Predictions & Winning Strategies

- Spring Equinox 2025 Celebrations: History, Traditions, and How to Enjoy the Day

- Trump’s Education Policies: What the Department of Education Means for 2025

- First Day of Spring 2025: Seasonal Traditions, Celebrations & Outdoor Tips

- Bulls vs Kings: In Depth NBA Game Analysis and Key Player Stats

- The Rise of Jordan Mason: Career Highlights and Future Prospects

- Hudson River: Environmental Insights, History & Scenic Exploration