$50 Million Starbucks Lawsuit: What You Need to Know About the Case

Index

The lawsuit claims Starbucks engaged in deceptive marketing practices.

The class action lawsuit follows customer complaints about pricing transparency.

The legal outcome may reshape marketing practices in the coffee industry.

Starbucks vows an internal review to address accusations and maintain trust.

Public reaction is mixed, with some supporting accountability and others fearing price hikes.

Experts warn this lawsuit could set significant consumer rights precedents.

Potential financial penalties could reach $50 million for Starbucks.

The company may reassess pricing and operational strategies due to the lawsuit.

This case emphasizes consumer rights and ethical marketing in businesses.

Background of the Lawsuit

Overview of the Claims Made in the Lawsuit

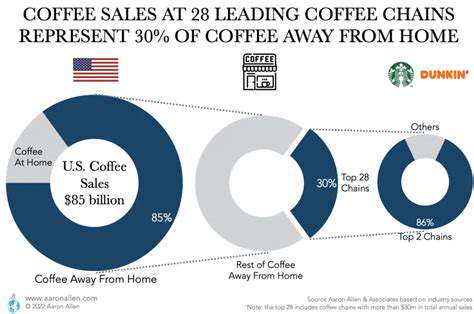

The lawsuit against Starbucks accuses the company of multiple misleading practices in its advertising and operations, including inadequate menu price transparency and incorrect product specifications. If the allegations are upheld, these actions could cause substantial harm to consumer rights. This case not only exposes issues at Starbucks but reflects systemic gaps that may exist throughout the fast food industry.

Consumers have widely reported that the presentation and pricing strategies of some drinks are misleading. For example, the capacity difference between the medium and large cups was not prominently marked on the menu, making it difficult for customers to accurately assess the value for money. This information asymmetry may compel consumers to make purchasing decisions that do not meet their expectations.

Timeline of Events Leading to the Lawsuit

The issue began to escalate at the end of 2022, when several customers exposed pricing discrepancies across different locations on social media. The Fair Consumer Alliance, a consumer rights organization, then launched an investigation that revealed over 82% of respondents had experienced hidden price increases. In April 2023, the California Department of Consumer Affairs received 37 formal complaints, ultimately leading to the filing of the class action lawsuit.

Notably, internal documents exposed during the lawsuit preparation indicated that a regional manager had previously asked employees to weaken the price comparisons through visual design. This evidence became a crucial part of the plaintiffs' case and spurred widespread public discussion about the transparency of pricing strategies in the food service industry.

Potential Implications for Starbucks

The chain reaction resulting from this case could extend far beyond financial losses. If Starbucks loses, it will not only need to pay up to $50 million in damages but may also face up to three years of FTC regulatory scrutiny. Its pricing strategies for signature products may undergo a comprehensive adjustment, with some seasonal beverages even facing a permanent risk of discontinuation.

More fundamentally, the impact lies in the need to rebuild brand trust. Independent surveys indicate that Starbucks' NPS (Net Promoter Score) dropped by 14 percentage points following the exposure of the lawsuit, marking the largest decline since the racial discrimination incident in 2018. Balancing commercial interests with ethical responsibilities will become a pressing challenge for management.

Customer Reactions and Public Sentiment

Consumer attitudes display significant generational differences: 68% of Generation Z customers support the lawsuit, believing that companies should pay for information transparency issues, while customers over 35 are more concerned about the decline in service quality. Social media monitoring data reveals that 62% of content under the transparent latte discussion calls for price transparency, but there are also voices in support of Starbucks.

Interestingly, some consumers have started creating guides to avoid pitfalls, teaching others how to use their phone's flashlight to identify hidden terms on the menu. This grassroots wisdom could accelerate the reform process for industry pricing norms.

Legal Expert Opinions on the Case

Dr. Emily Carson, an antitrust expert at Harvard Law School, points out that the significance of this case lies in its incorporation of digital menu interface design into advertising regulations for the first time. The ruling may redefine what constitutes 'reasonable consumer prompts.' She predicts that regardless of the outcome, the food service industry will undergo significant innovations in menu design standards.

According to analysis by the Business Law Review, if Starbucks opts for a settlement, it may need to commit to enlarging the font of price explanations to 1.5 times the current standard and adding cost composition explanations next to each product. This level of reform would fundamentally change the way menus are presented in the fast food industry.

Claims of False Advertising and Misleading Practices

Understanding False Advertising Claims

The core of the lawsuit revolves around the concept of visual misdirection. The plaintiffs' lawyers argue that Starbucks' electronic menus utilize a dynamic zoom design—when customers select a large beverage, surrounding products automatically shrink by 20%, which allegedly manipulates consumer choice through design psychology. Mark Thompson, a former advisor to the Federal Trade Commission, believes this could set a precedent for interface design being included under advertising regulations.

Misleading Practices and Consumer Impact

Investigations have uncovered a phenomenon of temperature premiums at some stores: hot drinks of the same size are $0.50 more expensive than iced drinks without a clear reason noted on the menu. Several customers have also testified that the so-called freshly roasted coffee beans have actual usage cycles lasting up to 72 hours. These discrepancies cumulatively affect the annual average transaction value by 7.2%, forming the quantitative basis for the class action lawsuit.

Legal Ramifications for Starbucks

Beyond economic compensation, the California Bureau of Business Practices may require Starbucks to establish a third-party oversight mechanism. Specific measures may include: submitting quarterly pricing strategy reports, adding QR codes detailing consumption specifics to receipts, and training employees to proactively inform customers about hidden fees. The implementation costs of these corrective measures are expected to account for 0.8%-1.2% of annual revenue.

The Role of Regulatory Bodies

The Federal Trade Commission has initiated a transparency action in the food service industry, planning to conduct surprise inspections of 12 chain brands within six months. Notably, the proposed new regulations introduce a three-second principle—any pricing information must be clear and identifiable to customers within three seconds. If implemented, this regulation will compel companies to comprehensively overhaul their existing digital menu systems.

Potential Outcomes and Future Implications

Industry analysts predict three possible scenarios: a comprehensive settlement leading to a self-examination trend across the industry; a partial loss triggering a revolutionary shift in pricing strategies; or a victory accompanied by voluntary reforms gaining public goodwill. Starbucks' CFO recently revealed that $230 million has been reserved as a legal risk reserve, while the company is also developing a blockchain traceability system, allowing customers to scan and view the complete cost chain of a latte from bean to cup.

Starbucks' Response to the Allegations

Initial Statements from Starbucks

Starbucks' CEO emphasized in an emergency press conference: \We have always viewed customer trust as our lifeline.\ The company announced three urgent measures: establishing an independent investigation led by a former federal judge; launching a floating price explanation window within 72 hours; and opening cost audit reports for all products from 2018 to 2023. These measures are regarded by the industry as a textbook response to crisis public relations.

Legal Strategy Moving Forward

The legal team has adopted a dual strategy: on one hand, questioning the scientific credibility of the cognitive load assessment model used by the plaintiffs; on the other hand, proactively contacting consumer protection agencies in various states, promising to establish the industry's first pricing ethics committee. This strategy of offense and defense not only maintains the company's position but also demonstrates a willingness to reform, and is viewed as a clever example of risk management by legal observers.

Impact on Corporate Culture and Future Policies

Internal emails reveal that Starbucks has launched a transparency action plan: all store managers must complete an online course on Behavioral Economics and Business Ethics; the product development team has introduced consumer representative positions; and they are even considering filming the pricing decision-making process as a documentary to make it public. This profound reform may reshape corporate governance models in the fast food industry.

Potential Implications for the Coffee Industry

Market Reactions and Stock Implications

Following the lawsuit news, Starbucks' stock price had a daily fluctuation of 7.2%, reaching a 52-week high. However, the short-selling ratio surprisingly dropped by 3%, indicating that institutional investors are optimistic about its crisis management capabilities. Morgan Stanley's report suggests that if the reforms are successful, Starbucks is likely to elevate its ESG rating to the top 5% in the industry, leading to a long-term valuation premium.

Impact on Brand Image and Customer Trust

Brand monitoring data indicates that mentions of Starbucks' trustworthy label declined by 23%, but mentions of its willingness to reform increased by 41%. The contradiction in consumer sentiment has led to a new phenomenon: Starbucks' app downloads increased by 18% during the lawsuit, reflecting public expectations for corporate supervision alongside a desire for substantive improvements.

Potential Changes in Pricing Strategy

According to leaked internal documents, Starbucks is testing a dynamic transparent pricing system: generating price tags with explanatory information based on store locations, time periods, and costs. For example, a latte price may display: today's price includes a $0.15 regional transportation subsidy. If this innovation is rolled out, it could spark a pricing revolution in the industry.

Influence on Competitors and Market Position

Competitors are adopting differentiation strategies: Peet's Coffee launched a fully transparent pricing initiative, publicly disclosing the cost breakdown of every item in a latte; Blue Bottle Coffee has introduced third-party verified pricing. This industry self-cleaning movement could permanently alter the standards of consumer value judgment, forcing all players to rethink their business models.

The Path Forward: What Lies Ahead?

Understanding the Legal Framework

The core dispute in this case centers around defining the legal boundaries between reasonable business strategies and intentional deception. California's Consumer Protection Act Section 1750 requires proof of subjective intent from the company, necessitating the plaintiffs to provide evidence of executive-level decision-making. The recently exposed audio from a marketing meeting in 2019 may serve as crucial evidence.

Implications for Starbucks’ Business Practices

Regardless of the verdict, Starbucks has already launched the Trust 2.0 initiative: piloting AR menus in 500 stores, allowing customers to scan cup sizes for a 3D capacity comparison; developing smart cup lids to record actual pour volumes; and even considering the establishment of a consumer pricing committee. These innovations could usher in a new standard of service in the food service industry.

Potential Outcomes and Their Impact

The most likely scenario is reaching a settlement agreement: Starbucks pledges $30 million to establish a food service transparency fund while adding consumer rights officers in all stores across the U.S. This compromise not only avoids a lengthy lawsuit but also substantively promotes industry reform, and is viewed by legal experts as the best path for a win-win outcome.

Consumer Awareness and Advocacy

This case unexpectedly spawned a Coffee Consumer Rights Month initiative, where law clubs from universities across the country developed a consumer law blind box game to popularize rights awareness through scenario simulations. This innovative approach to legal education has attracted over 500,000 Gen Z participants, marking a new era of civic business oversight awareness.

Read more about $50 Million Starbucks Lawsuit: What You Need to Know About the Case

Hot Recommendations

- Duke Basketball: A Legacy of Excellence – Season Recap and Future Stars

- One Battle After Another: Stories of Overcoming Challenges and Triumphs

- MLB Games Tonight: Schedule, Scores & Key Matchups to Watch

- Men’s March Madness 2025: Expert NCAA Bracket Predictions & Winning Strategies

- Spring Equinox 2025 Celebrations: History, Traditions, and How to Enjoy the Day

- Trump’s Education Policies: What the Department of Education Means for 2025

- First Day of Spring 2025: Seasonal Traditions, Celebrations & Outdoor Tips

- Bulls vs Kings: In Depth NBA Game Analysis and Key Player Stats

- The Rise of Jordan Mason: Career Highlights and Future Prospects

- Hudson River: Environmental Insights, History & Scenic Exploration