BYD Stock Analysis: Market Trends, EV Innovations & Future Projections

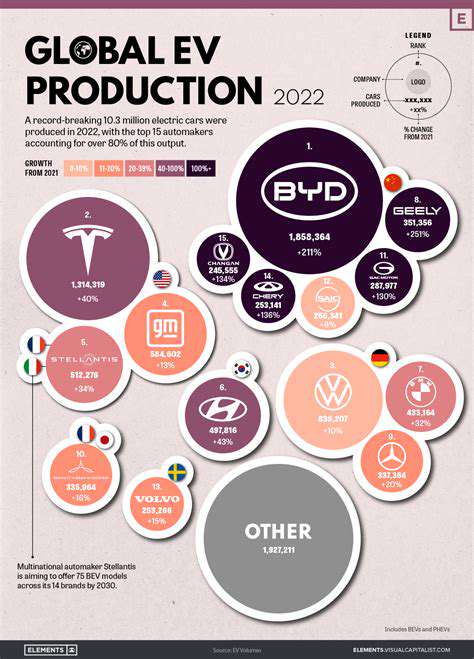

Market Trends and BYD's Dominance in the EV Sector

BYD's Global Expansion

BYD's rapid international growth has become a cornerstone of their recent achievements. The company has solidified its position across Europe while aggressively targeting North American markets. This worldwide footprint enables BYD to engage with varied consumer demographics and compete more effectively on the global stage.

Critical to this expansion are BYD's carefully cultivated alliances and targeted regional investments. These collaborations streamline local manufacturing and distribution networks, enhancing product availability and competitiveness in diverse markets.

Impact of Electric Vehicle (EV) Regulations

Global policy shifts favoring electric vehicles are dramatically transforming the automotive industry. Nations worldwide are implementing tougher emission controls while providing attractive incentives for EV purchases. These regulatory changes create ideal conditions for forward-thinking companies like BYD to thrive.

The resulting surge in EV infrastructure development and production capacity expansion represents a fundamental industry transformation. This paradigm shift promises to redefine transportation on a planetary scale for decades to come.

Competition and Market Share

The EV landscape grows more crowded by the day, with traditional automakers pivoting to electric models and innovative startups entering the fray. This heightened competition demands exceptional products, resilient supply networks, and creative business approaches to maintain leadership positions.

BYD's unwavering commitment to technological progress and efficient production methods has proven instrumental in maintaining its competitive edge against industry veterans.

Market rivals continuously challenge BYD to enhance its offerings and customer experience. This healthy competition ultimately drives industry-wide innovation while making electric vehicles more affordable for consumers.

Technological Advancements in Battery Technology

Breakthroughs in battery performance represent the lifeblood of EV progress. Rapid improvements in energy density, charging capabilities, and safety standards are accelerating automotive innovation. BYD's substantial R&D investments in battery technology provide a distinct competitive advantage.

The company's relentless pursuit of battery excellence clearly contributes to its current market leadership. This dedication reflects a visionary approach to the future of sustainable transportation.

Consumer Preferences and Adoption

Buyer attitudes are shifting decisively toward electric vehicles, influenced by environmental awareness, operating cost savings, and technological appeal. This profound change in consumer behavior is reshaping global mobility patterns.

Heightened ecological consciousness significantly impacts purchasing decisions across generations. This growing preference for clean transportation creates tremendous opportunities for well-positioned companies like BYD.

To meet evolving customer expectations, BYD must prioritize attractive designs, competitive pricing, and convenient charging solutions. These factors will prove essential for sustaining and growing market presence.

Analyzing Financial Performance and Future Outlook

Analyzing Key Financial Metrics

BYD's fiscal health provides critical insights into its growth potential. Evaluating revenue trajectories, profit margins, and cash flow patterns reveals operational effectiveness and shareholder value creation. Comprehensive financial analysis remains essential for understanding current stability and identifying future prospects.

Scrutinizing balance sheets, income statements, and cash flow reports allows for thorough evaluation. Key indicators like net earnings, operating costs, and capital investments help assess financial resilience and business model sustainability. Such examination enables stakeholders to gauge debt management capabilities, growth funding potential, and economic downturn preparedness.

Evaluating Market Trends and Competitive Landscape

The EV sector represents one of today's most fiercely contested markets. Grasping evolving consumer tastes, technological developments, and regulatory changes is paramount for assessing BYD's competitive position. Comparative analysis of rival strategies and market penetration rates helps evaluate BYD's capacity to defend or expand its market position.

Effective competitive assessment must incorporate brand strength evaluation, distribution network analysis, and pricing strategy examination. This comprehensive approach identifies relative advantages and vulnerabilities, offering valuable perspective on adaptability in a rapidly changing industry. Recognizing competitive pressures proves indispensable for accurate performance forecasting.

Assessing Future Growth Opportunities

BYD's expansion potential depends on its ability to seize emerging possibilities through product line extensions, new market entries, and technological innovation. Projecting future demand requires careful consideration of technological progress and shifting consumer priorities.

Growth potential in developing economies warrants particular attention, requiring evaluation of local regulations, infrastructure readiness, and consumer adoption curves. Strategic alliances should also be examined for their capacity to accelerate market access and fuel expansion.

Considering Risks and Uncertainties

Investment analysis must account for inherent risks including commodity price volatility, supply chain vulnerabilities, and policy changes. Thorough risk assessment examines potential impacts on financial results and long-term viability, including recession scenarios and corresponding demand fluctuations.

Geopolitical tensions, technological paradigm shifts, and sudden consumer trend changes present additional challenges. Comprehensive risk evaluation enables investors to make fully informed decisions regarding BYD's investment potential.

Read more about BYD Stock Analysis: Market Trends, EV Innovations & Future Projections

Hot Recommendations

- Hawks vs Hornets: NBA Game Preview, Key Players & Tactical Analysis

- Tornado Watch vs Warning: What’s the Difference and How to Stay Safe

- Alexandra Daddario: Hollywood Career, Iconic Roles & Upcoming Projects

- Wombats in Australia: Fascinating Facts, Conservation Efforts & Where to See Them

- St. Patrick’s Day 2025: History, Festivities & Modern Celebrations

- Fabian Schmidt: Profile, Career Impact & Notable Achievements

- Alex Consani: Profile, Career Highlights, and Notable Achievements

- Vivian Wilson: Profile, Career Milestones & What’s Next

- Harriet Hageman: Political Profile and Impact on National Policy

- Bryant University Basketball: Rising Stars and Season Highlights